In today’s competitive business world, expert QuickBooks training and consulting are essential for managing finances effectively. QuickBooks is a leading accounting software that simplifies financial tasks and boosts productivity. At Emerald Consulting, we are dedicated to helping businesses make the most of QuickBooks.

Why Choose QuickBooks?

Intuitive User Experience

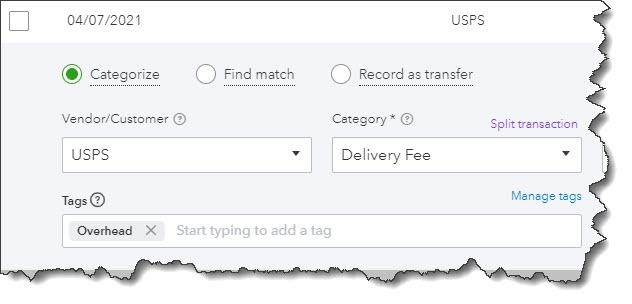

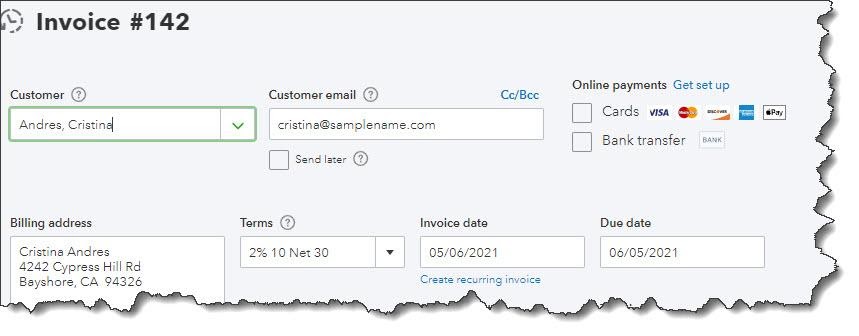

QuickBooks features a user-friendly design that makes accounting accessible for everyone. From tracking expenses to managing invoices and payroll, these tasks become streamlined, allowing you to concentrate on business growth.

Comprehensive Reporting Capabilities

QuickBooks offers robust reporting functionality. Through detailed financial reports, you can gain valuable insights into your business performance. The customizable reporting tools enable you to monitor key metrics and make data-driven decisions.

Seamless Third-Party Integration

QuickBooks connects effortlessly with numerous business applications, including CRM systems, e-commerce platforms, and payroll services. These integrations minimize manual data entry errors while optimizing your operations.

Professional Support From Emerald Consulting

Customized QuickBooks Solutions

At Emerald Consulting, we specifically design QuickBooks training and consulting services to match your business requirements. Our experienced team provides personalized training sessions, ongoing technical support, and strategic implementation guidance to ensure you maximize the benefits of QuickBooks.

Expert Implementation

Through our proven methodology, we help you optimize financial workflows, implement industry best practices, and maximize QuickBooks functionality. Whether you’re a small business or a growing enterprise, our solutions are tailored to drive efficiency and success.

Take Action Today

QuickBooks serves as more than accounting software—it’s your partner in business success. Working with Emerald Consulting unlocks its full potential, driving your business toward greater efficiency.

Contact Emerald Consulting now to discover how our expert QuickBooks training and consulting can streamline your business operations.